Can I switch my current account if I am overdrawn?

Yes. You will need to agree any overdraft facilities you require with us. Alternatively, we may be able to provide facilities to help you pay off any existing overdraft you may have, subject to our normal lending criteria. If you do not come to an agreement with us, you must make separate arrangements to repay your existing overdraft before you switch.

Is the Current Account Switch Guarantee the same for all banks?

Yes, all banks and building societies that display the Current Account Switch Guarantee Trustmark will follow the same switching process and must offer the same guarantees. See all UK participating banks and building societies Opens an overlay [Will show a security message first]

I have a joint account. Can I switch my current account?

Yes, as long as both parties agree to the switch and you are switching to another joint account. It is not possible to use the service to switch a joint account to a sole account.

Can I choose my switch date?

Yes, you can choose and agree a switch date with us. Just make sure you allow seven working days for the switch to take place and that your chosen date isn't a Saturday, Sunday or Bank Holiday.

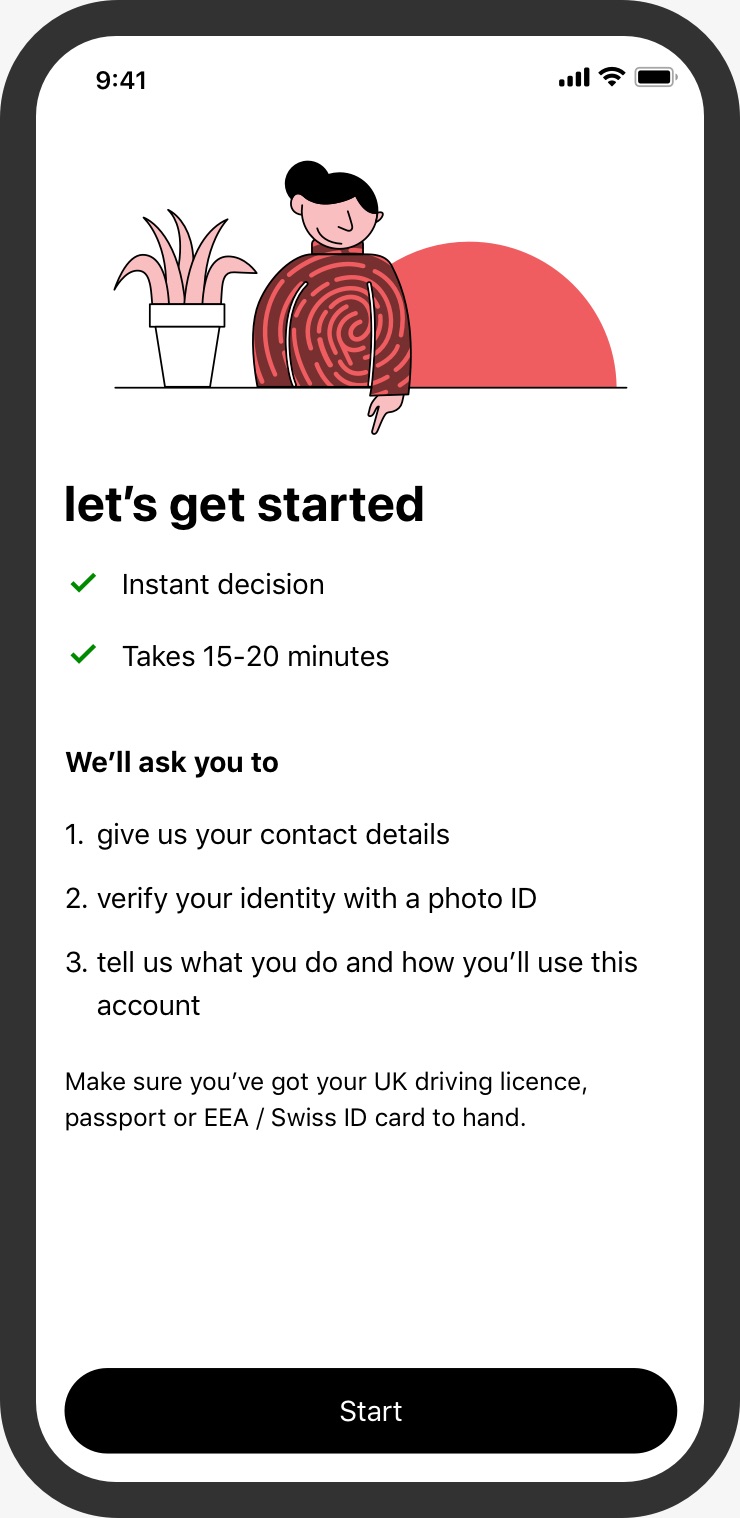

Are account opening and account switching all part of the same process?

Account opening and account switching are separate processes. first direct has to carry out 'know your customer' security checks as part of our account opening process. Once these are complete to our satisfaction, you can choose and agree your switch date.

Will the Current Account Switch Service automatically transfer new payment arrangements if I set them up at my old bank within 7 working days of the switch date agreed with first direct?

No. The Current Account Switch Service will take care of all payment arrangements at your old bank up until 7 working days before your agreed switch date. If you want to set up new payment arrangements during the 7 working day period leading up to your switch date you must do this on your new account.

Do I have to close my old account?

Your old bank will close your old account as part of the switching process. This ensures that any payments made to your old account are automatically redirected to your new account. If you want to, you can switch and keep the old account open, but you won't be able to use the Current Account Switch Service.

What happens to any debit card transactions or Direct Debits that I have asked my old bank to stop?

The Current Account Switch Service will not interfere with this process and any debit card or Direct Debit transactions that you have asked your bank to stop should remain stopped after your switch.

What if I change my mind?

You can cancel your switch up to seven working days before your switch date. After that, only certain elements can be cancelled. We'll guide you through this process if you decide to cancel your switch.

Will switching my current account affect my credit rating?

No, providing you repay any outstanding overdraft on your previous account as required by your old bank or building society. If there are any problems with payments as part of the switching process, we'll correct them and ensure your credit rating is not affected.

My Direct debit hasn't moved across after I've switched. What do I do?

If you're missing a Direct Debit and your switch is complete, contact us on 03 456 100 100. Remember all payments are covered by the Current Account Switch Guarantee and any charges or interest incurred on your old or new account as a result of the error will be refunded.